When you need cash quickly, the great thing to do is by using having a personal loan on the internet. You can find distinct advantages of a personal bank loan, rendering it perhaps one of the most sought after fund whenever anybody you desire money urgently. A knowledgeable ability of an unsecured loan would be the fact discover no limitation to presenting money should they is actually having courtroom purposes. And that, any kind of their mission could be, a consumer loan can be the best way to locate currency during the attractive interest levels.

Check out this weblog to know this new detail by detail procedure for obtaining an unsecured loan online and the items you will want to do to make sure speedy recognition of your own financing. Fundamentally, the job could be recorded during the five processes. But nonetheless, you need to lookup one what is the done procedure.

Step 1 Influence the main cause of Application for the loan

More often than not, you might see borrowers with not a clue about how exactly much money needed or don’t know how they can pay the amount. It is quite very easy to rating caught up in case the finance specifications is actually smaller, you qualify getting a top loan amount.

Once you apply for a personal loan on the internet, the fresh new recognition and interest believe of a lot factors such as for instance month-to-month earnings, monthly expenses, existing obligations, plus the balance of income. It is very important augment the purpose and you may quantum of the application for the loan. Imagine exactly how much you definitely wanted as well as how much is most. It is advisable to try to get the total amount which you however need and never that which you might require, once the a high loan amount means far more stress on the pockets when the installment duration begins.

Step 2 Determine Their Eligibility

Given that an educated borrower, you need to influence the eligibility well before trying to get the non-public loan on the internet. So you can assess the eligibility together with loan amount, you might use the non-public loan eligibility calculator. The brand new calculator can be found freely into lender’s site. Need certainly to look at all these criteria’s such, Profession, ages, money, wanted CIBIL Rating,

Besides the brand new monthly income and websites liabilities, the borrowed funds qualification as well as relies on your credit rating. With a top credit rating can make you permitted avail of advantages of a lesser unsecured loan interest. And don’t forget that whenever you make an application for an unsecured loan, the financing get decrease.

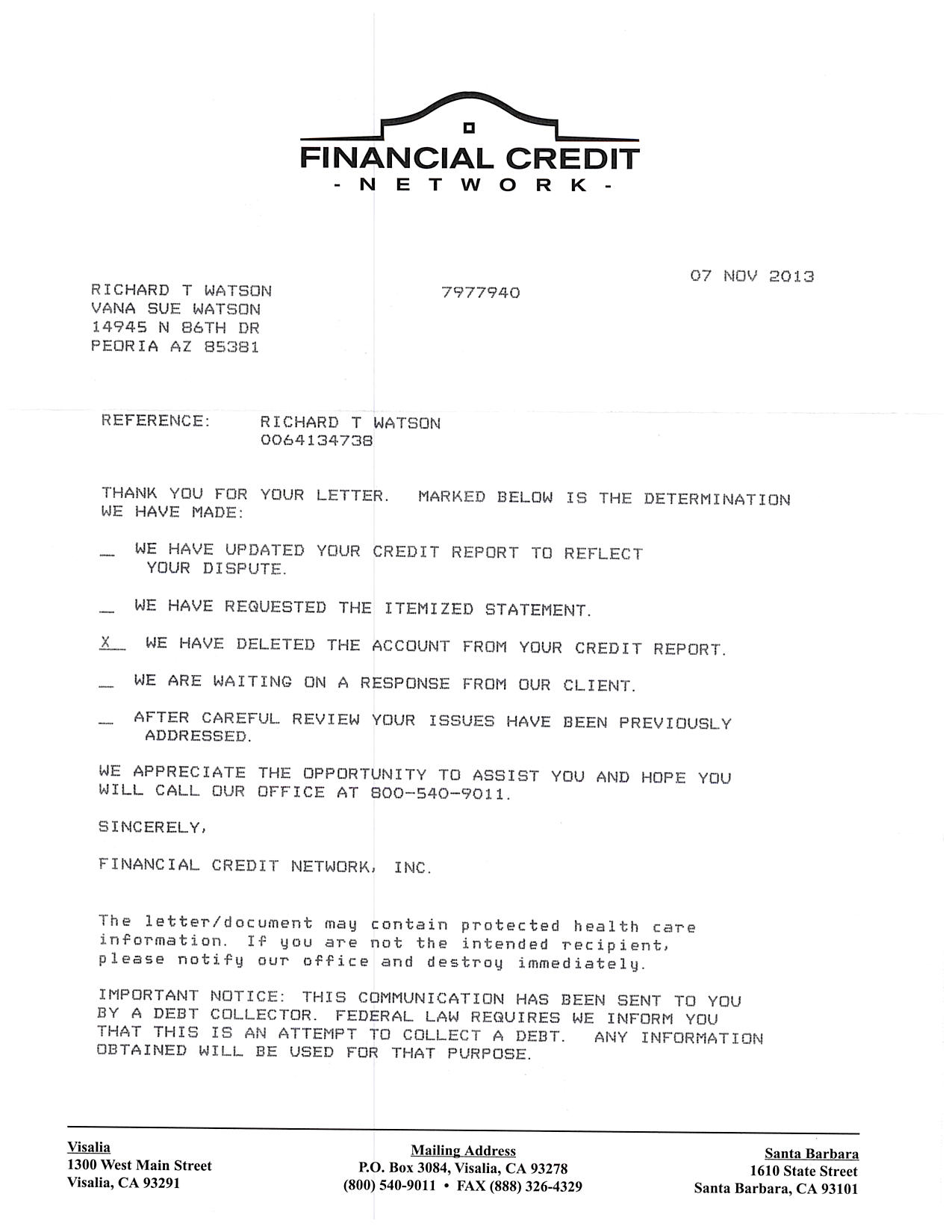

Step 3 Arrange Your articles

Generally, once you get a consumer loan loans in La Jara on line, the brand new confirmation processes is carried out on the web. You have to complete all of the called for crucial records such as KYC documents (Aadhaar Credit, Bowl Card, driving license, voter ID card), 2 months’ salary glides (to possess salaried), otherwise earnings evidence (getting worry about-employed) bank account declaration, taxation efficiency, and you may running percentage.

On top of that, all data standards change from the fresh lending institute. Ensure that the data files your submit is actually legitimate and you may brand new. Any untrue pointers will most likely not merely make you ineligible to use for new fund as well as generate a deep damage regarding the borrowing from the bank profile. elizabeth lending institute does not like otherwise Denay so you can accept the fresh new loan for you down the road.

Step Select the right Lender

Indian loan providers are incredibly active. Due to the individuals rules changes in this new monetary features community in recent times, lenders are extremely a bit competitive inside granting loans. Prior to, a borrower must await weeks or even months so you’re able to have the mortgage acknowledged. Not any longer, due to the fact after you submit an application for a consumer loan online , they usually becomes acknowledged within 1 day.

The fresh being said, its too challenging to choose the best bank. If you are selecting the right financial, you really need to carefully gauge the personal loan rates of interest, access to, convenience, conditions and terms, flexibility when you look at the payment, and you will preclusive charge.

Step 5 Spend EMIs timely

Once you apply for a personal loan on the internet , the lender confirms your own creditworthiness and you may immediately approves the loan by the sending the borrowed funds count straight to this new membership mentioned in the application form.

The latest due date off EMI drops on the same day’s each month, starting one month regarding date out-of mortgage approval. Ensure that you afford the personal loan EMIs on time, since any standard perform push the lender when deciding to take lawsuit, albeit because latest action. And this, it’s a good idea you to too have to estimate the EMI add up to have to pay. Determine your own EMI right here-

Conclusion

Trying to get a personal bank loan online in the attractive interest rates are the easiest action to take when you require currency to tackle during the time of abrupt economic problems. You that had stuck due to the paucity off fund. The main benefit would be the fact its a personal loan and you may doesn’t you want almost any collateral having trying to get the mortgage.

دیدگاهتان را بنویسید