The fresh Virtual assistant home loan system will be a very strong option which provides to own really-known benefits including zero down payment, zero monthly PMI, and versatile borrowing qualifying. But not, new Virtual assistant program normally a secret weapon to possess financing larger financing number which is especially important when writing about services that have large conversion prices.

Plus, when you yourself have not even complete, excite make the most of the totally free 2nd view service (SOS) which is great for each other the newest pre-qualifications and those finance already in progress. This is exactly a terrific way to receive a professional second viewpoint, double-view what your location is, and make sure that all essential financing stays on the right track!

Because a kick off point, when i make reference to the term Va Entitlement it means extent designed for a qualified experienced, services affiliate, otherwise thriving spouse to use to the financing therefore starts that have a fundamental entitlement out-of $thirty-six,100 and that loan providers generally play with to possess financing numbers to $144,100000.

Eligible Veterans loans Ordway, service players, and you can survivors having complete entitlement don’t has actually limitations into funds more than $144,000. It means you will not need to pay a downpayment, and now we make sure to your lender that if you standard on that loan that’s over $144,000, we’ll outlay cash doing twenty-five% of loan amount.

- Your Va mortgage work with has never been made use of, or

- You in past times paid down a Va loan completely and then marketed the home (i.elizabeth., Maintenance regarding Va Entitlement) or

- Your Va financial work with had previously been made use of, however, experienced a property foreclosure otherwise short profit and also have given that repaid the newest Virtual assistant completely.

Simultaneously, the latest county mortgage limit where in fact the home is discovered commonly pertain for those who have leftover entitlement under some of the following the facts:

- You really have a working Virtual assistant financing youre nevertheless paying back, otherwise

- Your paid down a previous Va financing completely and still very own the house, otherwise

- Your refinanced your own Va financing towards a low-Virtual assistant loan nonetheless individual the home, or

- You had a foreclosures otherwise quick profit (give up claim) towards a past Virtual assistant mortgage and failed to pay off Va entirely, otherwise

- You’d an action instead of foreclosure into a previous Va financing (i.e., you transmitted the new residence’s term with the bank one keeps their mortgage to get rid of foreclosures)

Please note one more entitlement, incentive entitlement, or level dos entitlement try terms employed by Va after they talk to lenders away from financing quantity greater than $144,100000

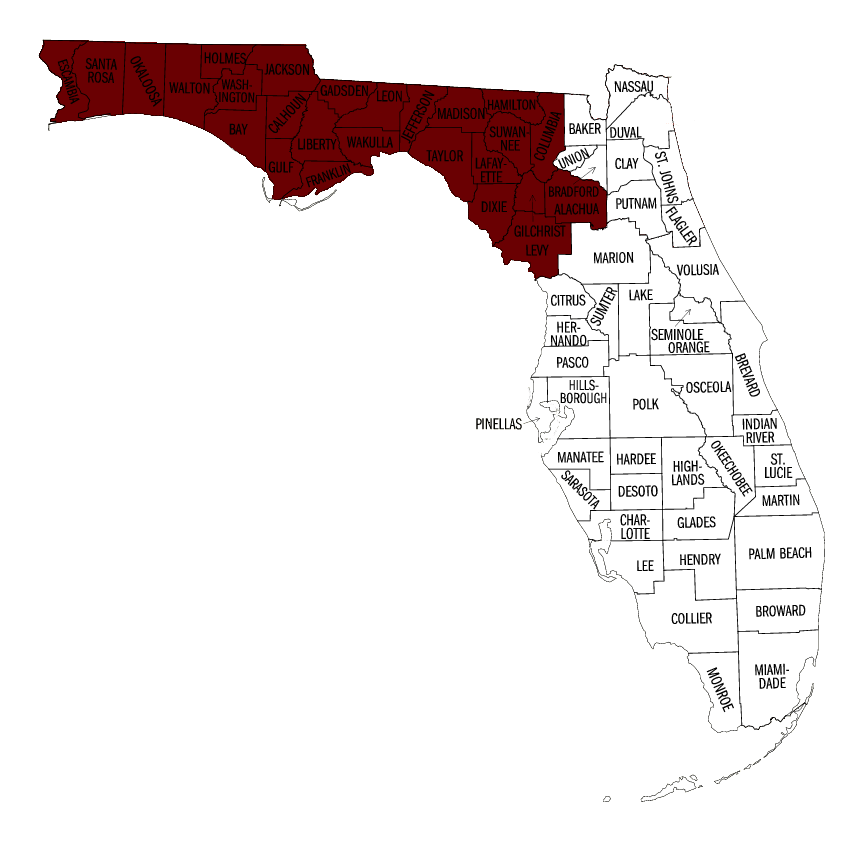

Take note you to while this was just a short summary and you can isnt designed to cover every Va mortgage maximum and entitlement related concerns, it will bring tips to keep in mind whenever calculating your own maximum Va amount borrowed in the Florida, Colorado, Tennessee, otherwise Alabama. For those who have people Virtual assistant loan restrict issues otherwise need assistance that have calculating their Va entitlement delight my group now so we can go to be right for you!

Just like the a good Va Recognized Bank, we shall walk you through the new Va loan qualifying process action-by-action. Merely name otherwise email address to talk about your own circumstances and you may let’s make suggestions new Metroplex difference!

In the current films I’ll give an explanation for facts close Va mortgage restrictions and exactly how Va entitlement products to your how higher off an effective Virtual assistant mortgage it’s possible to has

Thank-you once again to possess forwarding and you will revealing the current clips that have one family relations, family members, co-pros, otherwise readers who’re looking to purchase, sell, otherwise re-finance!

As usual, I want someone making it a beneficial date, and look toward watching you right here for the next tip of week!

دیدگاهتان را بنویسید