Q: You will find read that there is financing designed for and make repairs or enhancements so you can belongings. But exactly how carry out I understand and therefore brand of do it yourself loans are ideal for me personally?

A: You will find six fundamental brand of home improvement fund: household guarantee finance, family equity personal line of credit (HELOC), signature loans, cash-aside refinancing, handmade cards, and the FHA 203(k) Rehab Mortgage. Each of these has its positives and negatives. For example, specific finance need you to make use of your family while the security in the the loan (much more about that below), and lots of funds are more effective to have quicker plans having fewer expenses, for just starters. Lower than we’re going to coverage per mortgage enter in outline and in case it is reasonable to use that kind of financing getting do-it-yourself (which happen to be not the same as lenders).

step 1. Domestic Security Loan

Family collateral financing are one of the top types of do it yourself funds to have capital a house project. A survey off LendingTree learned that percent of men and women trying either a house equity financing or a house security credit line (much more about you to definitely later on) were utilizing one to financing getting renovations. A house guarantee loan is in introduction into the financial, plus the lender uses our home once the security on the loan. It indicates your contain the financial support towards the value of your own house, when you cannot afford the financing, the lender takes your property because the commission of financial obligation. Such financing is frequently named a great next home loan, since anyone obtain the mortgage to possess a lot of currency and should repay that cash over a particular time frame, usually within the equal monthly obligations. Remember, one matter your borrow and has a specific rate of interest you pay too. The speed is decided to some extent by the borrower’s income, credit rating, plus the value of our home. With respect to the Government Change Fee, many loan providers do not want men and women to obtain over 80 per cent of your equity in their home.

People secure such house repair loan because of loan providers and you will agents. There are even numerous key terms to know, and it’s important to know all components of the deal prior to taking up financing. If not know, query a representative of your own lender otherwise agent concerning the terms of the financing you try totally familiar with the fresh duties off settling the loan. One part of the loan is the annual payment price (APR), the total price some body buy borrowing from the bank, often called home improvement loan prices. Essentially, this is the charge you have to pay far above paying down the borrowed funds number. New Apr boasts the pace or any other fees, like representative costs. A lesser Annual percentage rate often means straight down monthly payments. These are along with usually repaired, meaning they don’t change-over the life span of your financing. Individuals along with spend attract with the entire loan amount.

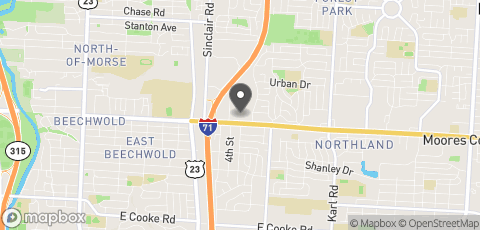

As soon as will it add up to acquire a home security financing to make use of just like the a renovation loan? Generally speaking, household equity financing take advantage experience for folks who have become purchasing on their family for some time or have their property entirely paid down. They have the extremely collateral to help you borrow once again in the place of heading more than one loans for bad credit Bakerhill AL open today 80 per cent credit recommendation listed above. Together with, when someone possess their residence paid down, they’re capable take on one more payment per month or 2nd financial. For the reason that it person was repaying interest to the whole count offered to him or her, what’s more, it makes sense to make use of these financing having one to large costs, such a different rooftop.

دیدگاهتان را بنویسید