Foreclosure by Financial: Recourse Financial obligation

A primary selling, property foreclosure, otherwise deed- in-lieu-of-foreclosure transaction may result in DOI income on borrower when recourse obligations try on it. When your number of obligations exceeds brand new FMV, the difference is treated given that DOI income if it is forgiven (Regs. Sec. step one.1001-2(c), Analogy (8); Rev. Rul. 90-16). The bid speed in a foreclosures revenue is actually presumed is the new property’s FMV until there was clear and persuading research to help you the alternative (Regs. Sec. 1.166-6(b)(2)).

DOI money occurs in a foreclosure deal only when the financial institution discharges area or all of people deficiency with the using the property securing they. If your bank does not go after the fresh creditor or even launch most of the indebtedness, DOI income show in the event that status (not as much as condition law) having enforcing your debt expires.

The latest lender’s delivering of the house into the pleasure of your recourse debt are addressed because a considered business that have continues equal to new decreased off FMV during the time of property foreclosure or perhaps the level of secured personal debt

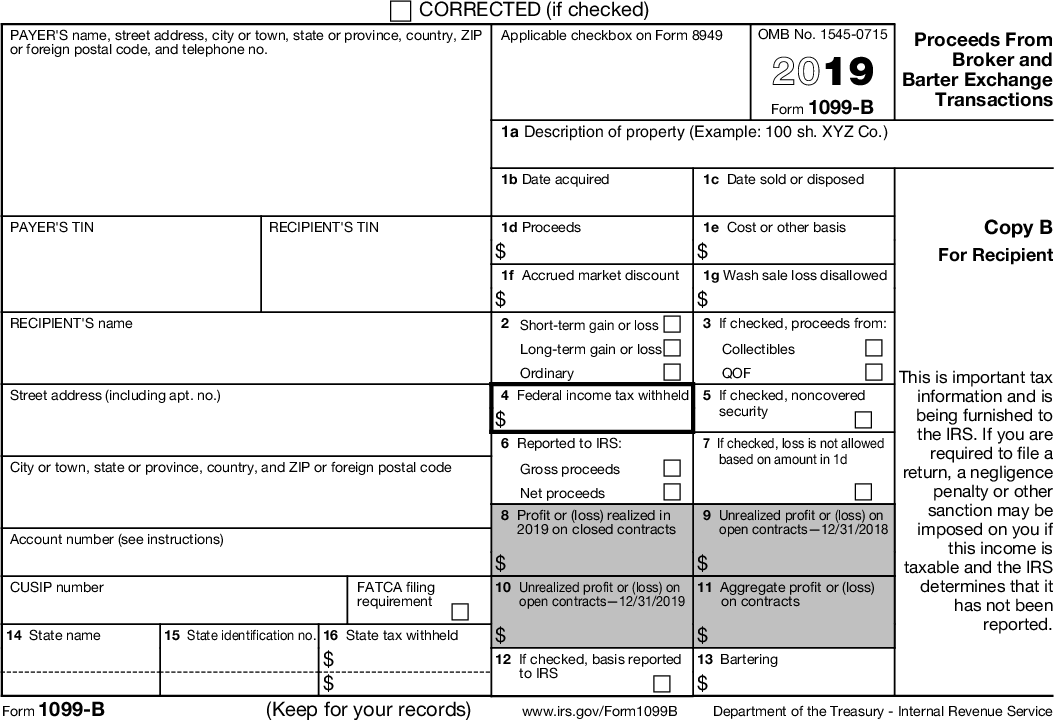

Whenever certain lenders (age.grams., financial institutions, coupons and funds, Emerald Mountain loans and other financial institutions) foreclose towards property and take possessions instead of foreclosure, they should thing an application 1099-A, Buy otherwise Abandonment out of Secure Possessions, on the borrower. This form provides suggestions such as the property foreclosure date, new the mortgage dominating harmony, and whether or not the debtor are actually responsible for repayment of your left balance. State rules control when a borrower is regarded as getting relieved away from a responsibility. The simple issuance regarding a type 1099-An effective isnt controlling if condition law will bring that launch happens in another type of taxation seasons. Some lenders necessary to file Setting 1099-A must along with procedure Function 1099-C, Cancellation out-of Financial obligation, for personal debt discharges. Yet not, this isn’t had a need to file each other Models 1099-An effective and 1099-C for the same borrower. Alternatively, simply Mode 1099-C should be submitted.

Example 2-property foreclosure toward private residence having recourse obligations: Meters and you will S purchased their house when you look at the 2001 to possess $3 hundred,100. Within the next ages, the real property sector is actually red hot, ultimately causing Meters and you can S’s household being appraised on $450,100000 within the . The happy couple chose to use a supplementary $one hundred,000 (home-security range, interest-simply repayments) against their residence regarding lender B having a house improvement project. From 2001 up to early 2006, Meters and you can S made its home loan and you can domestic-security range repayments quick. During the , when the a good dominant balance on the first-mortgage in addition to home-equity range was in fact $265,one hundred thousand and you may $100,100, respectively, they eliminated making repayments. The fresh new residential a home while the prices gradually decrease throughout every season.

During the , An advertised the house on a foreclosures business to possess $340,000 and you will is repaid new a good balance of their mortgage of $265,one hundred thousand. B was not as the happy and you will are repaid merely $75,000, leaving a lack of $25,100 you to B forgave. B delivered M and S an excellent 2006 Function 1099-C reporting DOI money of $twenty five,one hundred thousand.

Exactly what are the tax effects of deal? When possessions burdened of the recourse loans was foreclosed (otherwise transferred to the financial institution in the an action-in-lieu-of-foreclosure deal) together with personal debt exceeds brand new property’s FMV, the transaction is addressed as the a considered business at a rate equivalent to this new FMV. The latest deemed profit will cause a gain on profit away from Meters and you can S’s house of $40,000 ($340,one hundred thousand foreclosed bid $three hundred,000 base) during the 2006. Due to the fact B released the brand new $twenty-five,one hundred thousand lack, Yards and you will S will realize $twenty five,100000 DOI income inside 2006, and is completely nonexempt except if he could be bankrupt or insolvent.

The good news is that the $forty,100 get on profit should be entitled to exception below the newest Sec. 121 family sales acquire exception to this rule (Sec. 121; Regs. Sec. step 1.121-1). It acquire exception dont cover the new DOI money just like the DOI earnings cannot count since household marketing obtain. The fresh new DOI income appears in another type of deal between debtor and lender that will be taxable until one of several exclusions lower than Sec. 108 is applicable.

دیدگاهتان را بنویسید